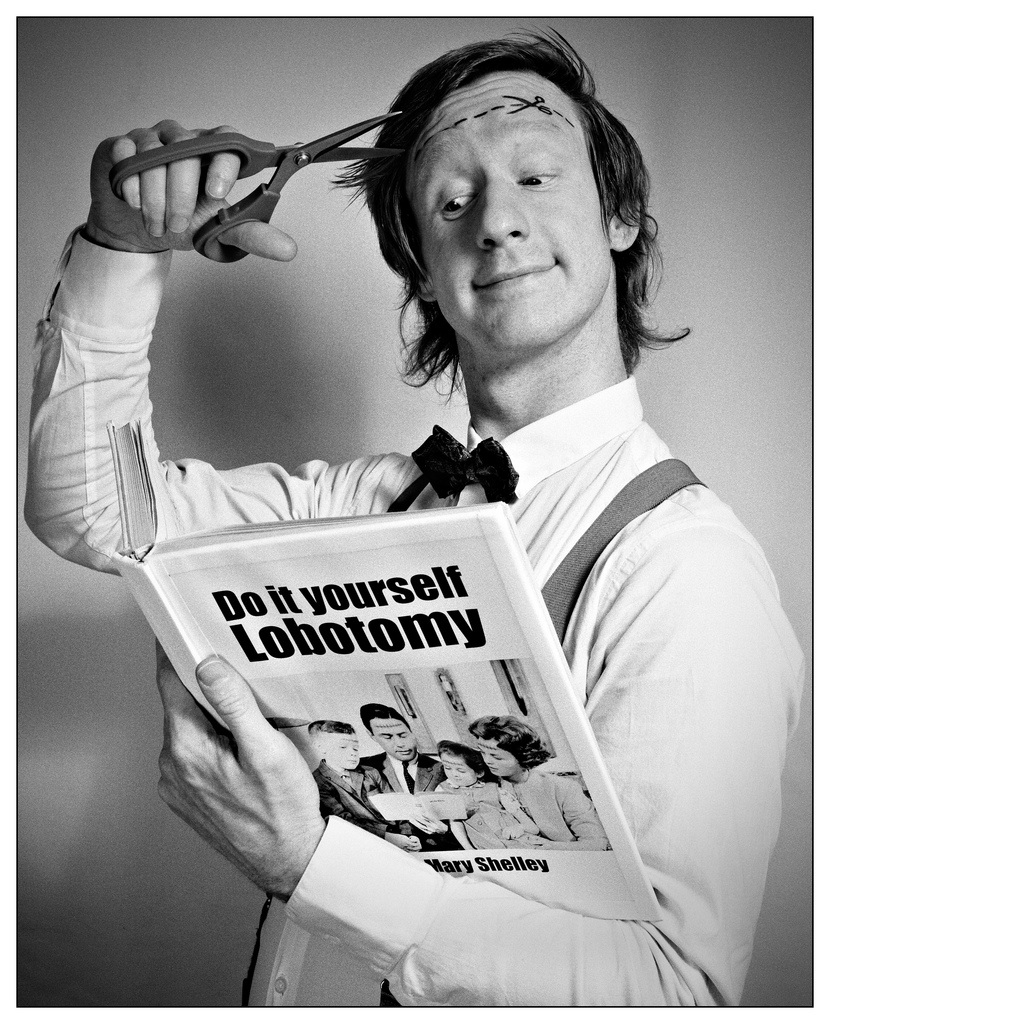

Beware of Doing it Yourself

Estimated reading time: 30 seconds

I've always admired the talents of people on cooking and renovation shows. Project oriented magazines like Popular Mechanics have fascinated me since I was a kid.

But the very thought of dealing with a project of any size causes nervous palpitations before pulling out my dusty toolbox. My affliction of two left hands breeds unvarnished respect for talented do it yourselfers - they truly deserve it.

Doing it yourself sometimes carries unintended consequences.

I was contacted recently by a businessman who read an article I wrote for the TaxLetter® back in 2011. It described how life insurance can provide a tax benefit before death by selling a personally - owned life insurance policy to one’s company. Read "Overlooked Strategy" HERE

He wrote to tell me that in December 2011, after reading my article, he sold his personally-owned universal life policy to his corporation and was shocked to subsequently receive a T5 indicating income of $43,000. He asked “What went wrong”?

Simple answer - he did it all himself!

It’s a shame that he didn't follow my advice to use an advisor or actuary familiar with these transactions. Every article I write contains at least one caveat to seek professional advice before implementing any tax planning arrangements.

We have done dozens of policy transfers and the first thing we would have discussed is how to deal with the cash value that’s always taxable on a transfer. We would have advised that there are ways to offset the gains but these things need to be considered beforehand.

I always tell people to get proper legal, accounting and tax advice before, not after.

Don't try brain surgery at home based on an article you read in The Lancet unless you are a brain surgeon.

Stay healthy.