Tax-Exempt Life Insurance in Canada

Most people know what life insurance is, but don’t know everything it can do.

Our clients buy insurance as an alternative investment to low risk, low yield, highly-taxed investments like bonds, GICs, etc.

The result is a worry-free investment that can grow at an equivalent taxable rate of return of more than 10%, can be accessed tax-free, and passed along to families and favourite charities tax-free.

Consider the following sample case:

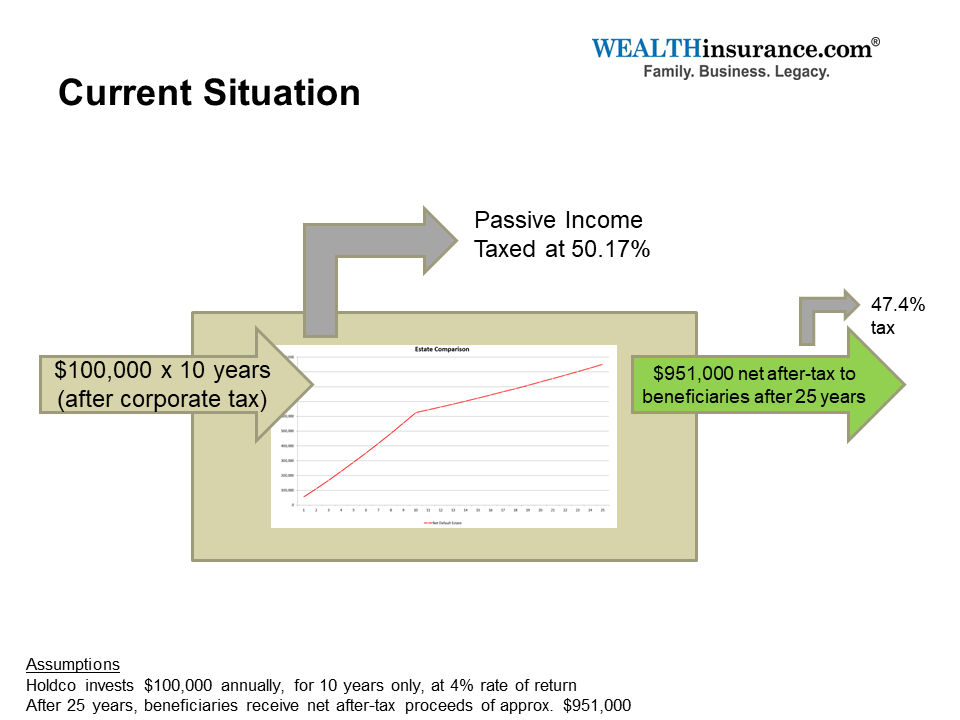

Current Situation

Married couple, age 65

Holdco deposits $100,000 annually, for 10 years only. Funds earn 4% rate of return. After 25 years, beneficiaries receive net after-tax proceeds of approx. $951,000 E&OE.

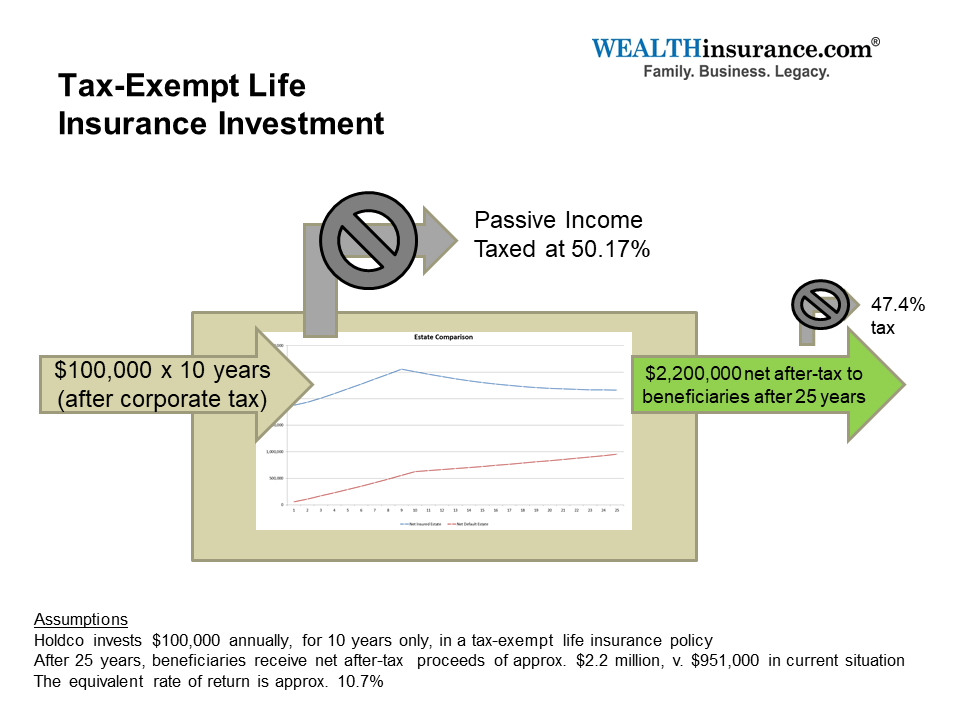

Tax-Exempt Life Insurance Investment

Married couple, age 65

Holdco deposits $100,000 annually, for 10 years only, in a joint last-to-die tax-exempt life insurance policy. After 25 years, beneficiaries receive net after-tax proceeds of approx. $2.8 million, v. $951,000 in current situation. The equivalent rate of return is approximately 13%

E&OE.

These policies are particularly attractive to real estate investors and business owners with unrealized capital gains.

If you qualify, you can buy life insurance using Immediate Financing Arrangements. This way, you pay only the interest cost, which is tax-deductible, and your money can remain in your real estate and business investments.

Contact us now to learn how this strategy can help you keep more of what you have worked hard for.